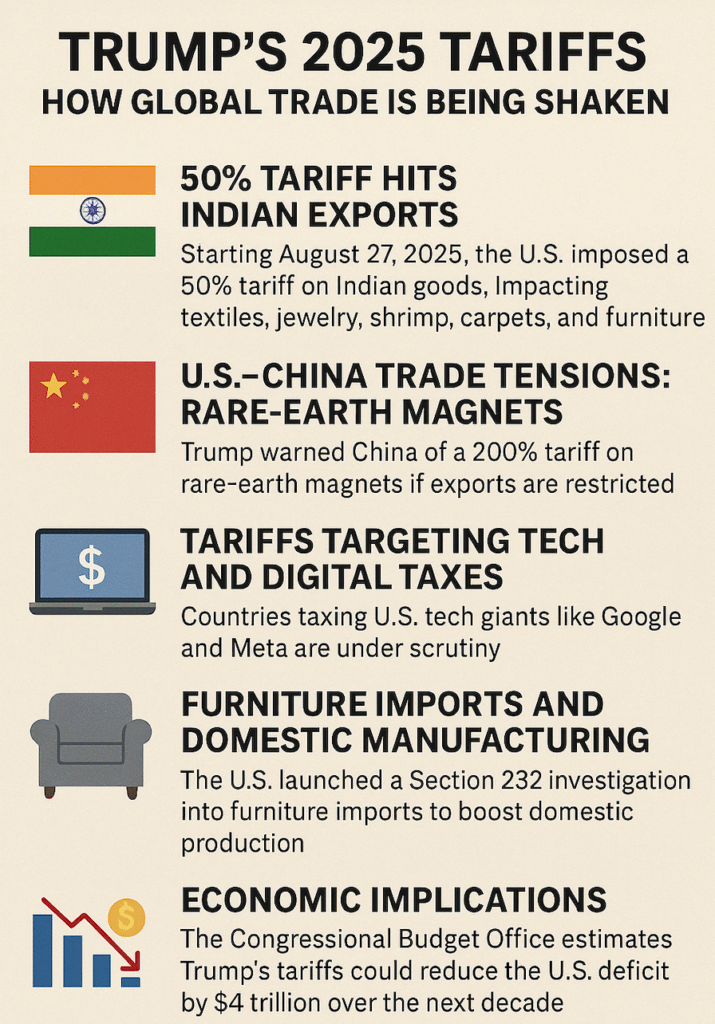

In August 2025, global trade has once again felt the tremors of tariffs under former President Donald Trump. From high-stakes U.S.–India relations to tensions with China and regulations targeting tech and furniture imports, the world is witnessing a major shift in trade dynamics.

India Faces Steep Tariffs

Starting August 27, 2025, the U.S. imposed a 50% tariff on Indian exports, targeting sectors like textiles, jewelry, carpets, shrimp, and furniture. The move comes after India continued purchasing Russian oil, sparking tensions in trade relations. Analysts predict this could reduce Indian exports by as much as 70%, significantly impacting labor-intensive industries and small businesses reliant on U.S. markets.

China and the Rare-Earth Magnets Standoff

U.S.–China trade tensions remain high, with Trump warning of a 200% tariff on rare-earth magnets if China restricts exports. These magnets are crucial for high-tech industries, including aviation, and a shortage has already grounded 200 Chinese aircraft. While Chinese officials dismissed the threat as a bluff, the episode underscores the fragility of supply chains in a hyper-connected global economy.

Digital Taxes and Global Tech Regulation

Trump has also targeted countries imposing taxes on U.S. tech giants like Google and Meta. The U.S. threatened tariffs on nations like the EU, Canada, Brazil, and South Korea in response to digital taxation policies. Earlier threats forced Canada to retract its digital tax proposal, highlighting the influence of trade policy on global tech regulation.

Furniture Imports and Domestic Revival

A Section 232 investigation into U.S. furniture imports, announced in August 2025, signals possible new tariffs to boost domestic manufacturing. States like North Carolina and Michigan, home to major furniture industries, could benefit if duties are imposed. However, the stock market reacted swiftly, with companies like RH seeing a sharp decline in share prices.

Implications for Global Trade

The Congressional Budget Office estimates that Trump’s tariffs could reduce the U.S. deficit by $4 trillion over the next decade, by increasing revenue and cutting federal interest payments. While this may bolster U.S. finances, it raises concerns about retaliation, supply chain disruption, and higher costs for consumers worldwide.

What Businesses Should Do

Companies engaged in international trade must stay agile. Diversifying supply chains, reassessing sourcing strategies, and closely monitoring U.S. trade policies are now more crucial than ever. Firms exporting to the U.S. should anticipate higher tariffs and explore alternative markets to mitigate potential losses.

Conclusion:

Trump’s tariffs in August 2025 highlight the intricate balance between national economic policy and global trade relations. While the U.S. may benefit in terms of revenue, countries like India, China, and others face significant disruption. Businesses, policymakers, and consumers alike must navigate this evolving landscape carefully, as international trade enters a period of heightened uncertainty.

Leave a Reply